salt tax cap removal

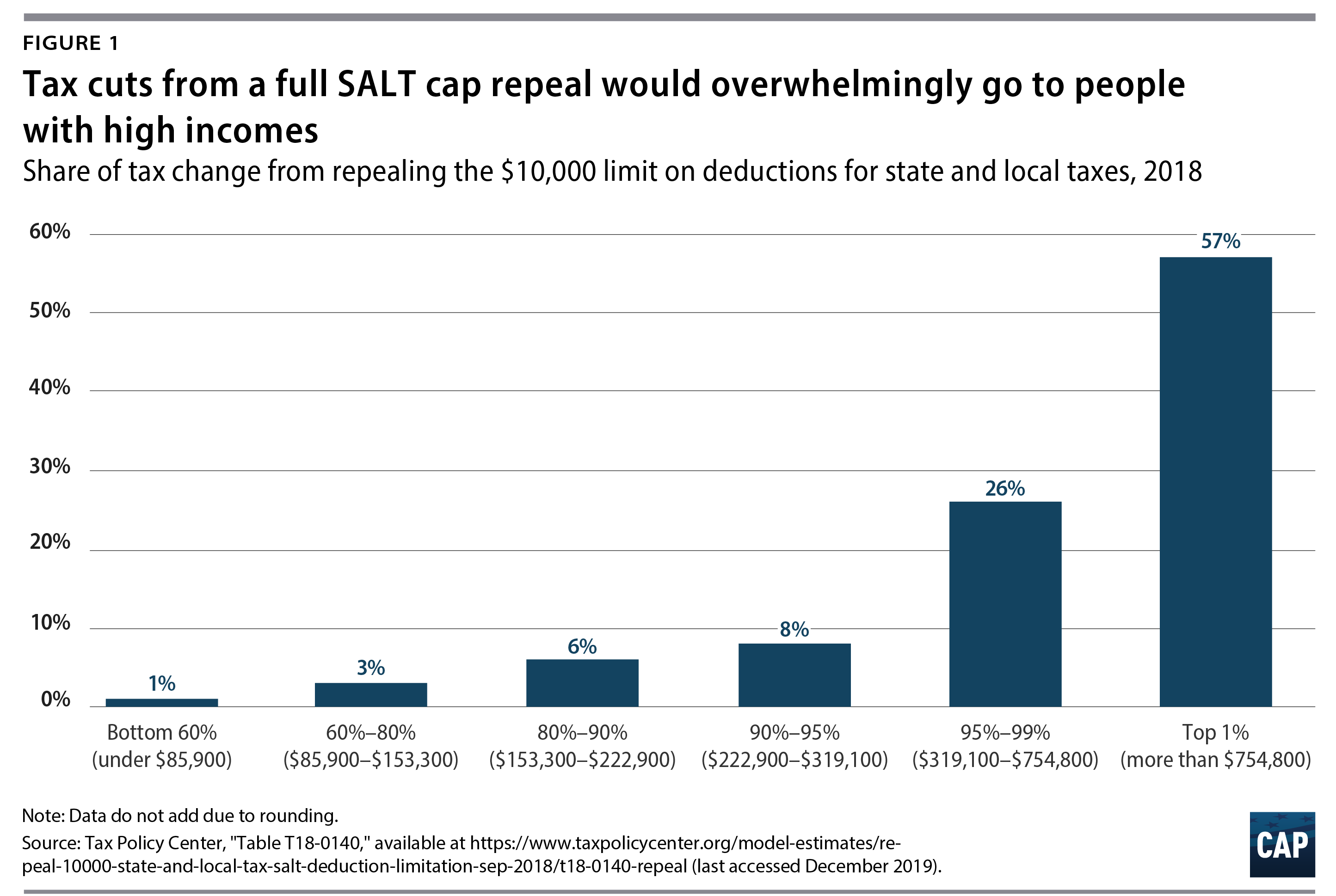

Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. Ace Removal in Monroe Township.

California Approves Workaround to SALT Deduction Cap.

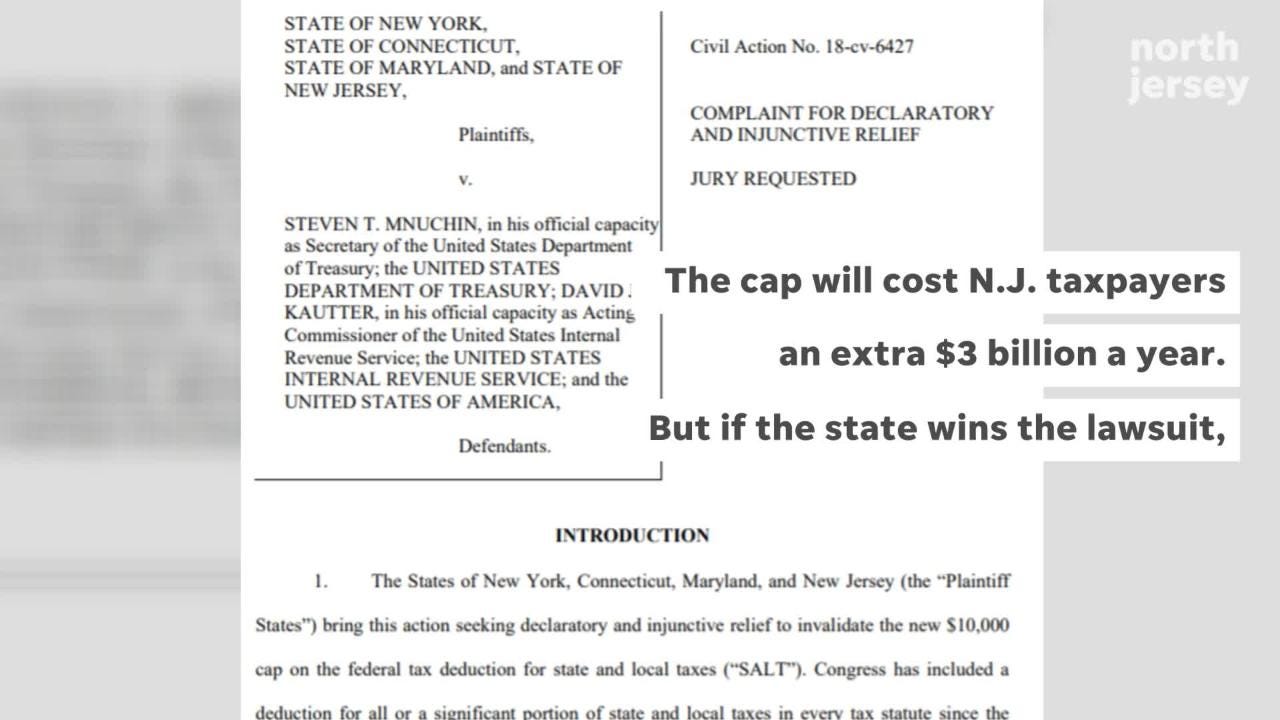

. Prior to that the average SALT deduction in. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized. Tom Suozzi writes For 100 years Americans relied on this deduction Letters. The bill would raise the cap to 60000 for filers making 400000 to 500000 then reduce it by 10000 for each 100000 of income.

The governors on Friday argued For the first time since Abraham Lincoln created the federal income tax the cap on SALT deductions established a system of double taxation. Finally if we look at the net effect of how taxes on higher income families in high tax states are doing after. House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the.

For example at 25MM income the tax increase was 92k or about 37 of income. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. This means you can deduct no more than.

But Trump and Republicans placed a 10000 cap on deductions for state and local taxes called SALT in government speak. The deduction would be zero for filers. By Joey Fox October 20 2021 252 pm Responding to reports from yesterday that the State and Local Tax SALT deduction cap lift may be removed from President Joe Bidens.

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. The California Franchise Tax Board reported that in the 2018 tax year the SALT cap cost Californians 12 billion. But a downstream impact would be to remove a bit of the.

Marc Elrich Says Not So Fast On Salt Tax Cap Repeal

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Suozzi Meeks Want Salt Cap Repealed Qchron Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

Murphy Pushing For Salt Cap Removal Isn T Willing To Make An Ultimatum New Jersey Globe

Igor Bobic On Twitter According To A Summary Of The Budget Resolution The Finance Committee Is Being Instructed To Include Salt Cap Relief In The Reconciliation Bill Twitter

Effort To Restore Full Salt Tax Break Picks Up Momentum In D C Crain S Chicago Business

Squad Votes For Salt Deduction That Bernie Sanders Branded A Tax Break For The Rich

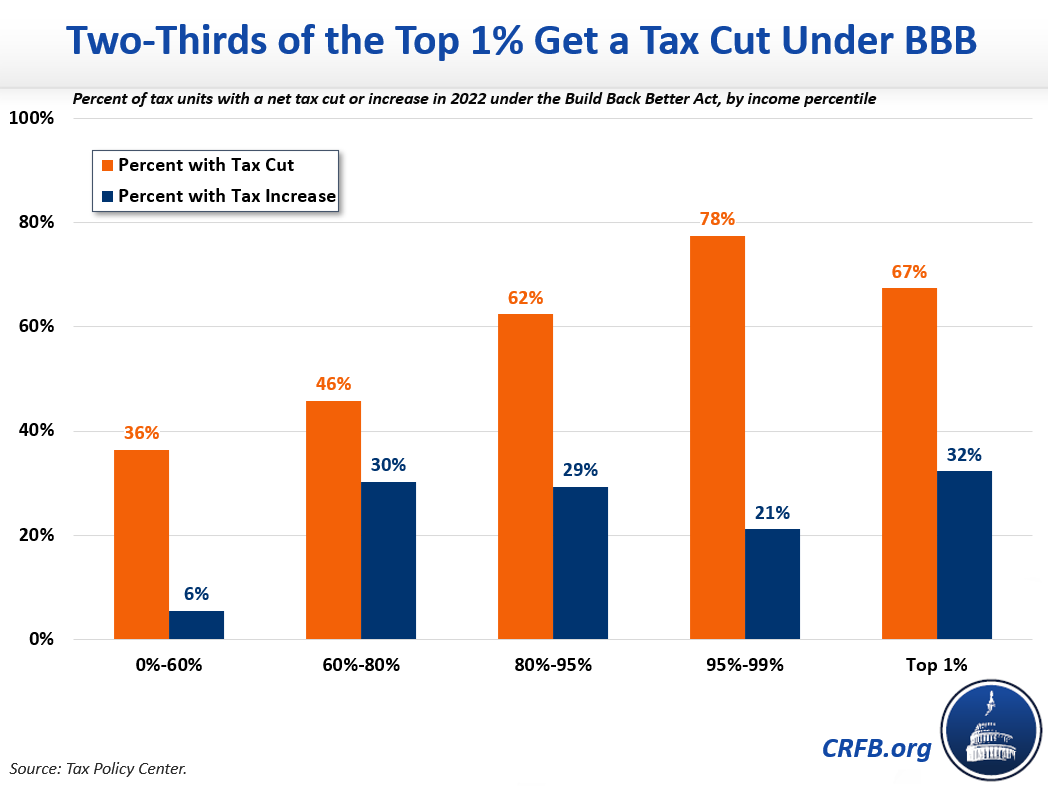

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

New York Business Leaders Push Biden Schumer To Remove Cap On Salt Deductions

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Chuck Schumer Mitch Mcconnell Fight Over Salt Cap Removal

Changes To The State And Local Tax Salt Deduction Explained

State And Local Tax Deduction Cap Repeal Does Not Belong In Reconciliation Package Crfb Director Youtube